June’s inflation data show the real cost-of-living impact on the lowest-earning workers. Here are five key takeaways from the LRS Inflation Monitor.

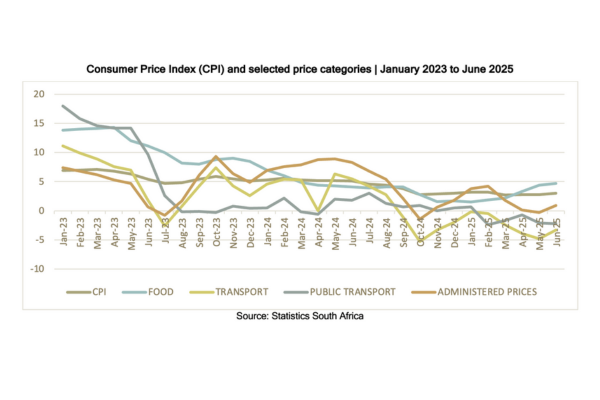

1. Inflation is rising

The official inflation rate rose to 3% in June, up from 2.8% in May.

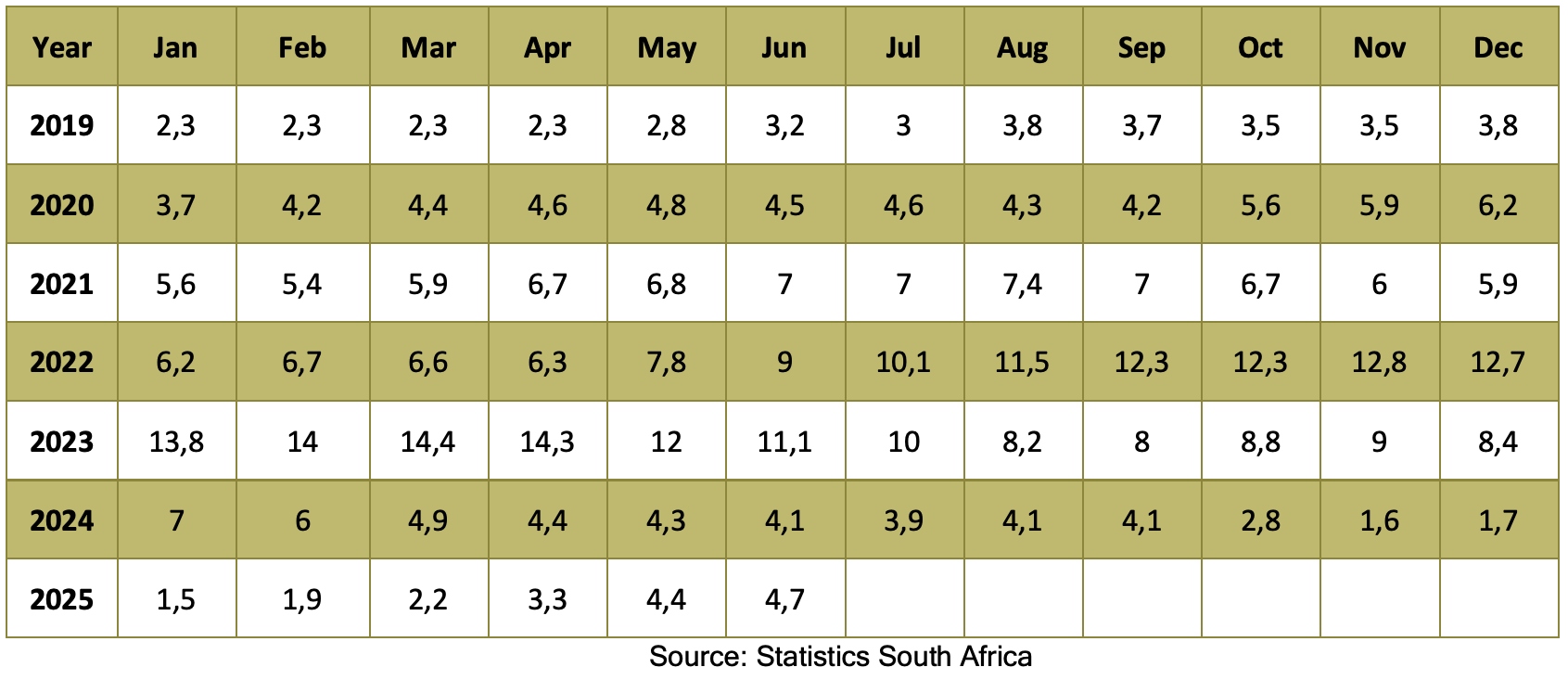

Food prices increased to 4.7%, continuing an upward trend. Low-paid workers and households are most affected since food comprises a significant portion of their expenses.

Food Price Index (%)

2. Low-income workers face higher inflation than the headline number

Statistics South Africa breaks inflation down by spending levels. Here is what it looks like:

- Decile 1 (up to R1 678/month): 4.7%

- Decile 10 (R26 021+/month): 2.9%

The poorest households are facing inflation above the official average.

3. Administered prices increased

Prices set or influenced by government or a single provider, such as school fees, telephone charges, electricity, petrol/paraffin, and public transport, rose to 0.9% in June, up from -0.3% in May.

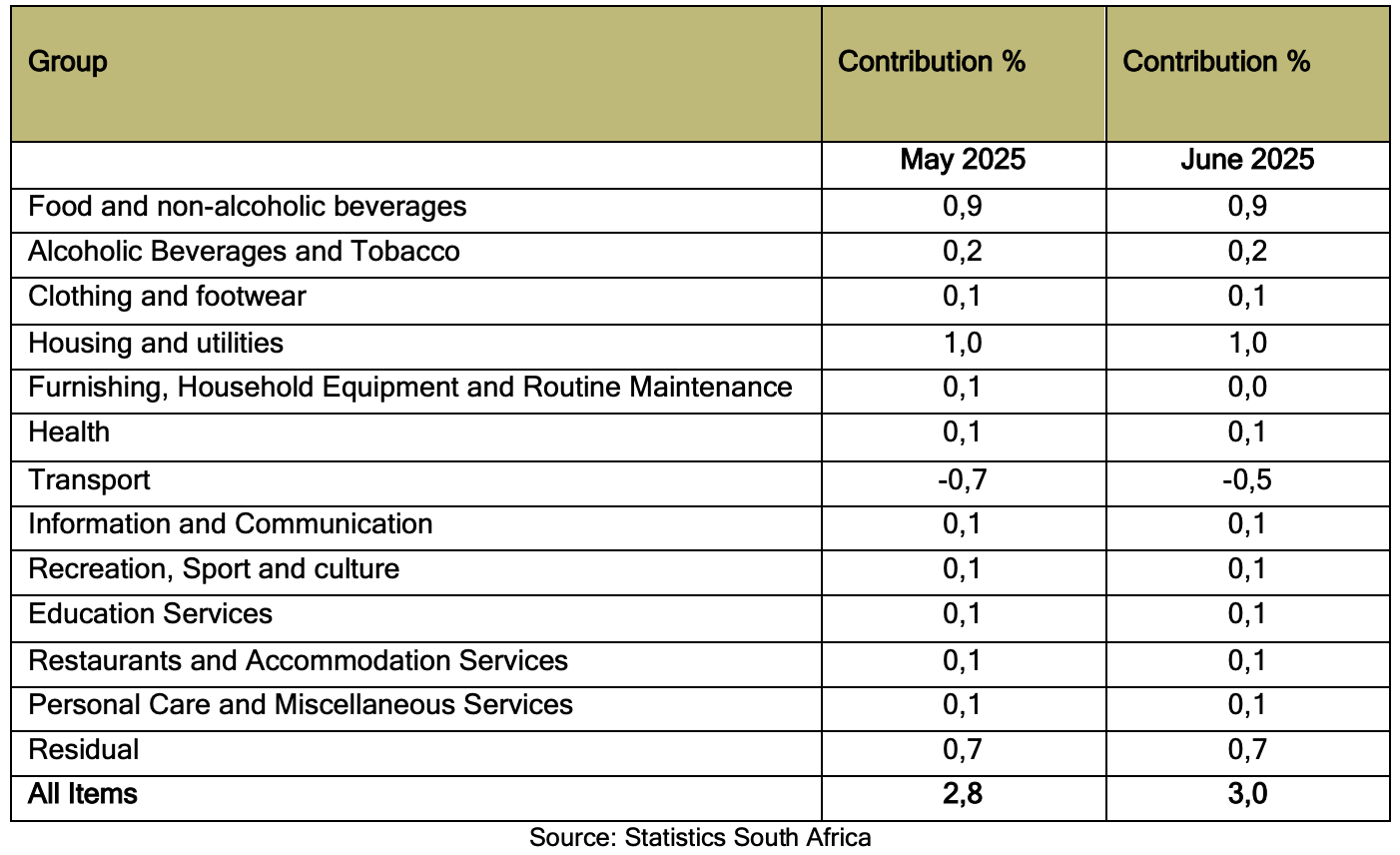

4. Housing costs remain a key pressure point

Housing and utilities accounted for 1% of the CPI, the largest contributor to the annual change in the CPI headline. Transport inflation remains negative at -3.3%, but it has improved slightly since May.

Contributions of the different groups to the annual percentage change in the CPI headline

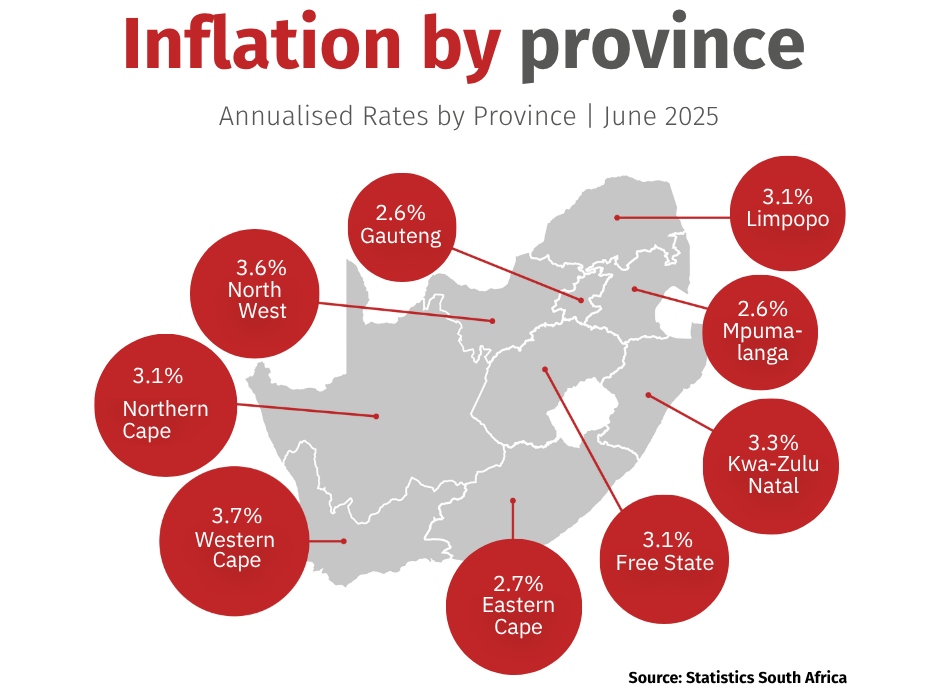

5. Inflation is not the same everywhere

Limpopo, Northern Cape, and Free State (all at 3.1%), KwaZulu-Natal (3.3%), North West (3.6%), and Western Cape (3.7%) recorded annual inflation rates above the national average.

View: Inflation Monitor | June 2025

RELATED RESOURCES

- Bargaining Benchmarks | July 2025

- An introduction to wage bargaining

- An introduction to negotiations