Photo: Ashraf Hendricks, GroundUp

Every year, the government plans how it will spend the country’s money. This is called the budget. It’s not just one decision; it’s a process where Parliament debates and approves how taxes are used. It’s always good to stay informed about these changes, as they can affect your daily life.

The Minister of Finance presents the budget, but it’s not final. After the presentation, parliament committees review it, and then they vote on it. This can take a couple of months. This year it looks like there will be a lot of political uncertainty, which may lead to a delay.

The good news is that social grants are going up, albeit modestly. This helps with the rising cost of living. Old age, disability, and care dependency grants will increase by R130. Child support grants will increase by R30. Foster care grants will increase by R70.

The Social Relief of Distress (SRD) grant (R370 per month) has been extended until March 2026. This is a big help for those who are unemployed.

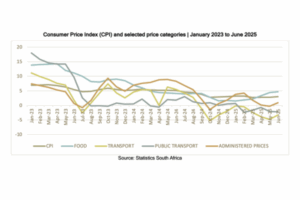

The biggest news is that VAT is set to increase. VAT is added to a lot of items sold in South Africa as an additional tax, and this helps the government increase its budget. As VAT is increased, the cost of some things will increase. This will affect everyone, but especially those with low incomes. So, while the government is planning to increase social grants, other increases (like VAT and inflation) will likely cancel out this increase. To help with this, the government has added more food items to the list of things that don’t have VAT (zero-rated items). This includes things like canned vegetables and certain meats.

The government has allocated money for public employment programs and job creation through the Unemployment Insurance Fund (UIF). However, there are concerns about how the UIF is managed.

The budget will also make no amendments to current tax brackets – meaning tax brackets will not be adjusted to account for inflation. It is important to remember that as your wages increase, without changes to tax brackets, you may end up paying a larger percentage of your income in taxes.

We’ll be keeping a close eye on what all these changes mean for workers, as well as the voting process in parliament.

Also read:

Valuing care work: What are the prospects for women in the National School Nutrition Programme?

How relief grants can be used to help young people into jobs