In negotiations, the wage demand tabled by the trade union is more persuasive if it can be shown the demand is reasonable in some way. Wage negotiators build an argument for a higher wage by comparing the current wage to several benchmarks, including inflation.

The latest inflation number tells you what has happened to prices over the last 12 months. The source of inflation information is Statistics South Africa. Statistics South Africa publishes the consumer price index, which measures the increase in prices (of a basket of goods and services) over time. The CPI is published monthly, with a lag of one to two months.

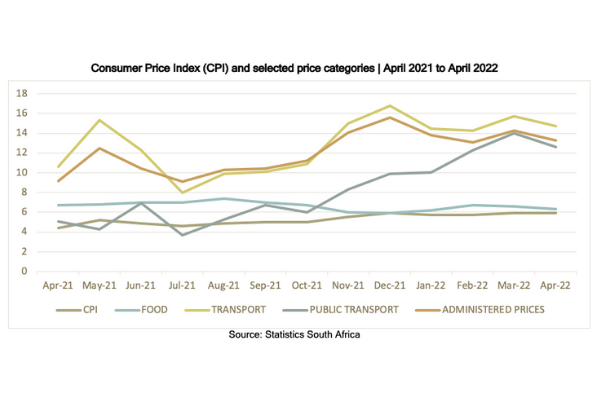

You can find a simplified version of monthly inflation on this website by searching for ‘Inflation Monitor’. View the inflation trends for April 2022, or find the original publication on www. stassa.gov.za.

Understanding inflation

Inflation and wages

Inflation should not dominate wage negotiations, but it is an important consideration. Inflation tells you about the buying power of a worker. If a worker gets a 5% increase and inflation is at 5%, then the buying power of the worker stays the same. If a worker does not get an increase for a time, then the buying power of their wage will decrease because prices tend to increase over time.

What is a real wage and real increase?

An example:

The current wage is R4000 per month in March 2022. The wage increase on the table is 6%. The latest inflation rate available is CPI 5.9% in March 2022 (This describes the increase in prices between March 2021 and March 2022).

If inflation stays at 5.9% in the months to come, then that is the increase that is needed just to protect the value of the wage. Anything less than 5.9 %, and workers will become poorer.

In this example, we hope that the increase in workers’ wages in the previous year was greater than 5.9%, otherwise, they have less buying power than they had before.

The increase of 6% is greater than the estimated inflation rate by 0,1%. The real wage increase is 0,1%. In theory, this worker should have 0,1% more buying power than they did before.

In practice, this will depend on what they spend their money on and what the inflation rates are for the items that take up most of their spending.

You can also look back at past settlements and compare them to inflation to see what gains and losses workers have made in the past.

The inflation numbers that we have now hold clues about what inflation will be in the next period. Look at the trend in inflation over the last 12 months to see if it has been rising, falling, or up and down.

The Producer Price Index (PPI), also published by Statistics South Africa, can help you predict what inflation might do going forward. If PPI has been rising for the last 3 months, then that increase might begin to show in consumer prices (CPI) within the next few months. The graph below shows the monthly CPI and PPI between September 2020 and September 2021.

Consumer Price Index (CPI) and Producer Price Index (PPI): Month-on-month Annualised % change

Online tool - LRS Wage Calculator

The LRS wage calculator will help you with wage negotiations.

Try it and understand:

- how much a percentage increase is an amount of money

- the percentage increase from one wage level to another wage level

- the real increase after inflation

- the money value that is left of the increase after accounting for price increases

The wage negotiator's checklist for dealing with inflation in wage increases

- What is the wage increase percentage that is on the table?

- What is the latest rate of inflation?

- What is the trend in inflation over the last 6 months or more?

- What does it tell us about the likely inflation rate over the next 12 months

- Are there any other reasons why inflation might increase or decrease significantly in the coming months?

- Is the wage increase greater than inflation?

- How much of the increase is left after inflation?

- How much do we want the buying power of the wage to increase by?