CEO of BHP Billiton Mike Henry is the highest-paid, with a total remuneration of over R 258 million.

While South African lawmakers are pushing for mandatory disclosure of pay ratios between directors and workers, many companies still lack transparency in executive compensation. Executive remuneration extends beyond base salaries, encompassing bonuses, long-term incentives (LTIs), stock options, and various benefits like healthcare, car allowances, and retirement plans. These components are not always clearly disclosed, making it difficult for stakeholders to understand the true cost of executive pay.

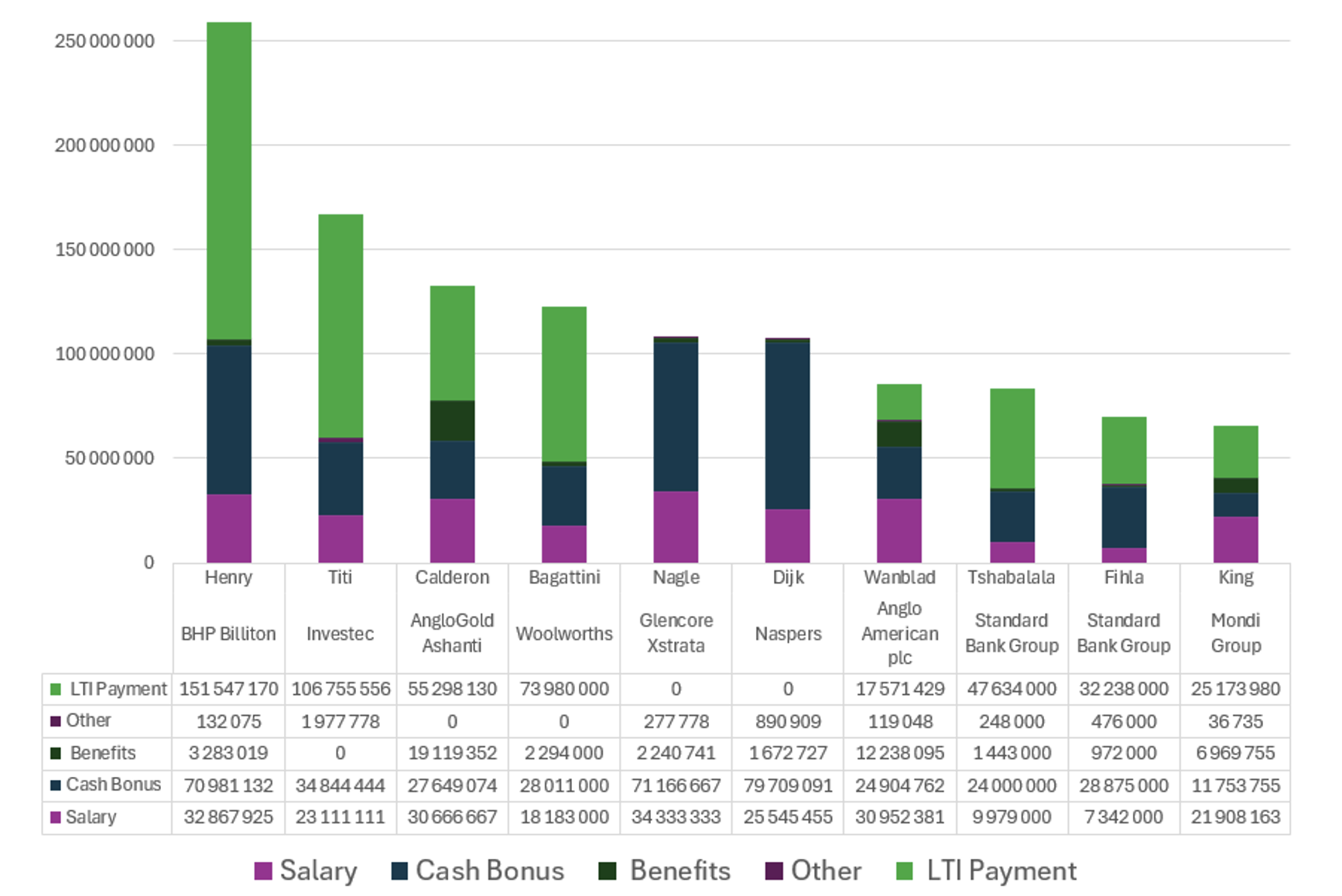

Companies have different financial year-ends, leading to delays in data collection and making timely comparisons difficult. The LRS monitors over 60 JSE listed companies, with data going back over ten years. Our 2023 analysis reveals that the top ten highest-paid CEOs in our sample are all men, with a significant majority being white. Here’s the list of the top ten highest paid CEOs:

| Company Name | Director Surname | Total remuneration including LTI |

| BHP Billiton | Henry | ZAR 258 811 321 |

| Investec | Titi | ZAR 166 688 889 |

| AngloGold Ashanti | Calderon | ZAR 132 733 223 |

| Woolworths | Bagattini | ZAR 122 468 000 |

| Glencore Xstrata | Nagle | ZAR 108 018 519 |

| Naspers | Dijk | ZAR 107 818 182 |

| Anglo American plc | Wanblad | ZAR 85 785 715 |

| Standard Bank Group | Tshabalala | ZAR 83 304 000 |

| Standard Bank Group | Fihla | ZAR 69 903 000 |

| Mondi Group | King | ZAR 65 842 388 |

Mike Henry of BHP Billiton, who has been at the helm of the company since 2020, is the highest-paid CEO in our sample with total remuneration of over R 258 million. This is inclusive of an LTI payment of R 150 million. The company made profit before tax of over R 400 billion in 2023 and employs over 80 000 people across the world.

Investec CEO, Fani Titi, is second in our list with total remuneration of over R166 million. This includes an LTI of over R100 million. Investec employs just over 8 000 people.

The below table gives some insight into the remuneration packages afforded theses executives:

View a larger image.

The bulk of most of these executives’ packages are made up of LTIs (shown as green on the chart), with cash bonuses and salaries making up the rest.

Another notable measurement is the ratio to national minimum wage (table below). Proposed new legislation would make similar reporting mandatory for companies, given insight into the enormous pay gaps these companies often hide.

A report by PWC concludes that the gap between CEO pay and the national minimum wage is presented as a “rather reasonable” 66 times. However, the below list shows a different picture. BHP Billiton has an over 4000 pay ratio, Investec over 2700, Anglogold Ashanti over 2200 and Woolworths over 2000. These gaps are immense and a clear indication that these companies are not committed to closing the wage gaps (and corresponding inequality) in South Africa.

| Company Name | Total including LTI | Ratio to SA minimum wage |

| BHP Billiton | 258 811 321 | 4 314 |

| Investec | 166 688 889 | 2 778 |

| AngloGold Ashanti | 132 733 223 | 2 212 |

| Woolworths | 122 468 000 | 2 041 |

| Glencore Xstrata | 108 018 519 | 1 800 |

| Naspers | 107 818 182 | 1 797 |

| Anglo American plc | 85 785 715 | 1 430 |

| Standard Bank Group | 83 304 000 | 1 388 |

| Standard Bank Group | 69 903 000 | 1 165 |

| Mondi Group | 65 842 388 | 1 097 |

Inequality in South Africa is deepening. The high salaries and perks enjoyed by top executives exacerbate this.

It is important for the government, communities, and civil society, especially trade unions, to carefully consider the impact of remuneration policies, and it is the obligation of companies to ensure that these contribute to the overall well-being of the country and its people.

For more information and company specific financials, please take a look at our database available here: https://lrs.dedicated.co.za/mnc/.

RELATED ARTICLE

Time for transparency on executive pay in South Africa