Inflation directly impacts the cost of living for workers and serves as a key reference point for wage bargaining. The LRS Inflation Monitor simplifies inflation data to assist negotiators. View the November 2024 issue of the Inflation Monitor.

What is inflation?

Inflation refers to a sustained increase in the general price level of goods and services, measured as an annual percentage increase. A falling rate of inflation does not mean prices are decreasing – rather, they are increasing more slowly.

The Consumer Price Index (CPI) is the most commonly used measure of inflation. Referred to as the headline or official inflation rate, the CPI is calculated by monitoring monthly price changes across more than a thousand goods and services.

Implications for negotiations

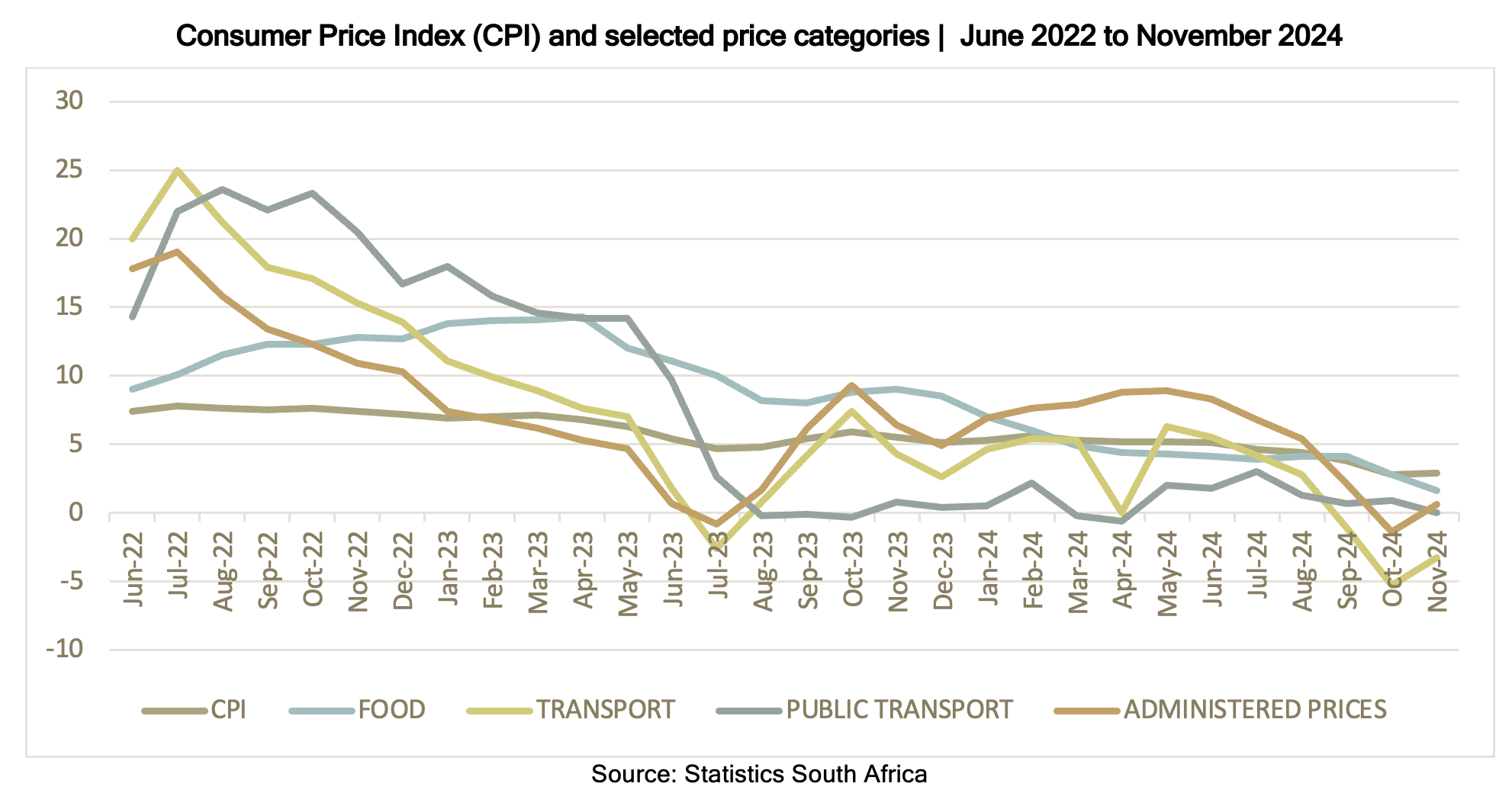

- The headline inflation rate is 2.9% in November 2024, but this is not everyone’s experience.

- Look at how specific categories, such as food, transport and administered prices are changing, as these affect your members differently.

- Different groups of workers can experience different inflation rates depending on what they buy. The monthly household expenditure is divided into 10 deciles, from the lowest (up to R1 678 per month) to the highest (R26 021 and more). Lower-income households are disproportionately affected by inflation.

- Different groups contribute to the overall inflation rate. For instance:

- Food and non-alcoholic beverages contributed 0.7% to the CPI in October and 0.4% in November.

- Transport contributed -0.8% to the CPI in October and -0.5% in November.

- Inflation also varies by province. In November 2024, Limpopo had the lowest at 2.4%.

- Check the inflation trends in different sectors over the past few years. Look at the last 12 months to determine if inflation has been rising, falling, or fluctuating. Current inflation numbers can indicate future trends.

Checklist for dealing with inflation in wage increases

- What is the wage increase percentage that is on the table?

- What is the latest rate of inflation?

- What is the trend in inflation over the last 6 months or more?

- What does it tell us about the likely inflation rate over the next 12 months? Are there any other reasons why inflation might increase or decrease significantly in the coming months?

- Is the wage increase greater than inflation?

- How much of the increase is left after inflation?

- How much do we want the buying power of the wage to increase by?

"Inflation should not dominate wage negotiations, but it is an important consideration. Inflation tells you about the buying power of a worker. If a worker does not get an increase for a time, then the buying power of their wage will decrease because prices tend to increase over time."

- An Introduction to Wage Negotiations | LRS Negotiator’s Guide

RELATED RESOURCES

- An Introduction to Wage Negotiations: Learn how to build an argument and formulate a wage demand.

- Bargaining Benchmarks | December 2024: Five benchmarks to help union negotiators participate as informed role players.

- Wage Calculator: Calculate how much a percentage increase translates into monetary terms and how inflation affects wage increases.

- South Africa Trade Fact Sheet: supports international trade advocacy by South African trade unions, particularly their campaign for an African Continental Free Trade Area (AfCFTA) that benefits workers.